Capital Markets

Solutions

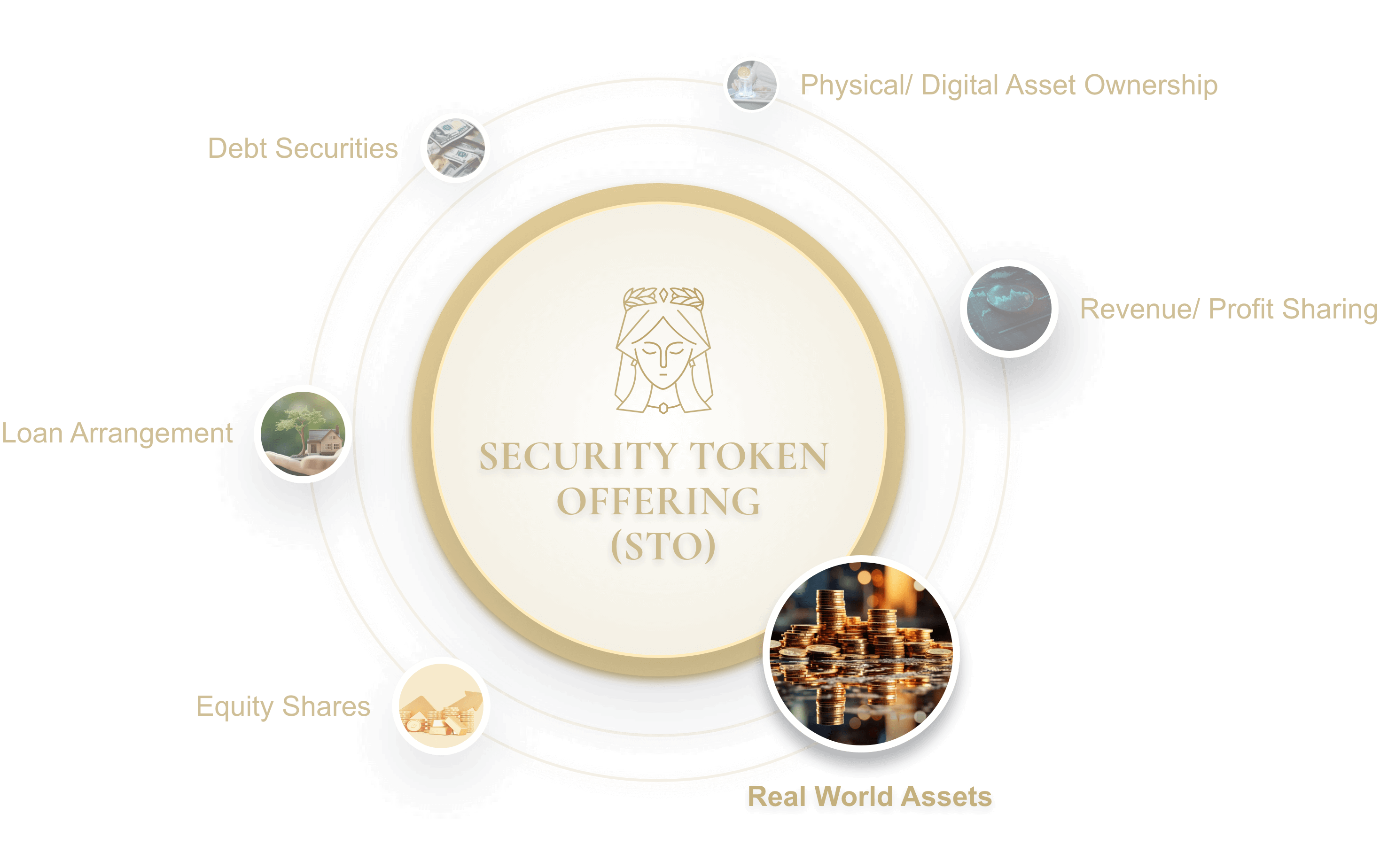

Access to capital via our tokenized fund security token offering (STO) solutions. TCG Fintech provides support in the origination of special-purpose tokenized funds and manages the structuring, tokenization, marketing and distribution of these funds.

Contact us to learn more about our Capital Markets Solutions.

…Unlocks New Opportunities With Proven Traditional Capital

And Financial Markets Business Model

Key

Advantages

Lower Entry Threshold

Compared with traditional bonds (USD 200,000) and institutional bonds/monetary funds (more than USD 1 million), tokenization can significantly lower the entry threshold.

Immediate Secondary Market

Investors can trade 24/7 through over-the-counter market provided by fund managers, or on regulated trading platforms in the future.

A Natural Stablecoin Use Case

Currently, the global circulation of U.S. dollar stablecoins is about 111 billion USD, and there is a huge demand for allocation to high-quality traditional financial products (stablecoins have no interest, and decentralized financial products are non-compliant).

Real-Time Settlement

Fund tokens are settled in real-time using blockchain.

Zero Regulatory Risk

Fund tokenization is currently the only product structure permitted by the Hong Kong Securities Regulatory Commission SFC to be used in fundraising and secondary market transactions.

Learn more about us…

![]() 18/F, On Hing Building, 1 On Hing Terrace, Central, Hong Kong

18/F, On Hing Building, 1 On Hing Terrace, Central, Hong Kong

![]() cs@tcg-fintech.com

cs@tcg-fintech.com

![]() +852 21552618

+852 21552618